Operations Review

Operations Review

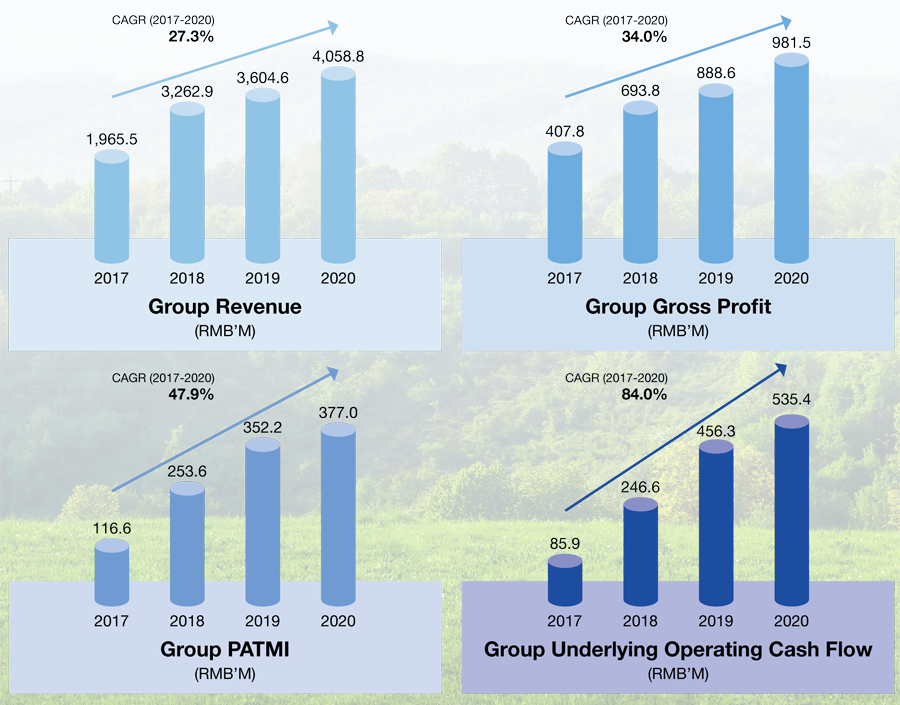

GI FINANCIAL HIGHLIGHTS

Robust Financial Performance with Growth

2022 was the most challenging year ever for Sunpower since

the inception of the GI business. Several force majeure events

affected business operations during the year. The pandemic

broke out and spread through the country from the beginning

of the year, culminating in the lifting of pandemic control and

prevention measures at the end of the year. The geopolitical

conflict which broke out in February set off a global energy

crisis and caused energy prices to soar globally. Further, other

related events including power curtailment due to extremely

high temperatures also took place in 2022. As a result, the

operations of the GI projects and their customers were affected

throughout the year.

Despite these challenges, demand for steam remained strong

and growing. Total steam sales volume rose 9.5% YoY to 8.68

million tons in FY2022. Meanwhile, GI recurring revenue1 rose 38.9% YoY to RMB2.88 billion, faster than the growth in steam

sales volume, mainly due to the significant rise in steam price

based on the price adjustment mechanism. Further, GI project

profitability improved on the back of the strong demand

for industrial steam, the execution of the price adjustment

mechanism and the Mitigation Measures2. GI recurring EBITDA3

rose 32.8% YoY to RMB598.0 million, while GI recurring PATMI4

grew 31.2% YoY to RMB158.2 million. Operating cash flow of

the GI projects5 rose 43.0% YoY to RMB364.1 million.

Sunpower will continue to focus on improving shareholders'

value in the long run. The Group remains well placed to benefit

from the long-term growth potential of the centralised steam

supply industry and circular economy industrial parks in

China. It is expected that a high NPV of future cashflows will

be generated.

Note:

*After adoption of Amendments to SFRS(I) 1-16: Property, Plant and Equipment: Proceeds Before Intended Use that came into effect on 1 January 2022 and is retrospective for FY2021 financial results.

1 GI recurring revenue refers to recurring revenue generated by the GI business, including commission fees recognised in accordance with SFRS(I) INT15. It excludes one-time contributions from services for BOT projects, including EPC services, that are performed by the Group's internal project management department, recognised under IFRIC 12 Service Concession Arrangements.

2 Refer to the 1Q 2022 earnings release dated 15 May 2022 for more information.

3 GI recurring EBITDA refers to the recurring Earnings before Interest, Tax, Depreciation and Amortisation of the GI Business. It excludes gains or costs incurred by way of the Manufacturing & Services (M&S) business disposal such as excess cash dividends, gain on disposal, withholding tax, etc. in 2021; one-time contributions from services for BOT projects, including EPC services, that are provided by the Group's internal project management department, recognised under IFRIC 12 Service Concession Arrangements; as well as expenses incurred by the Company that are not related to the running of the GI Business, such as listing-related expenses and remuneration of the employees at the group level, etc., which reflects the operating results of the GI business.

4 GI recurring PATMI refers to the recurring Profit After Tax and Minority Interests of the GI Business which reflects the profit of the GI business attributable to the Group. It excludes gains or costs incurred by way of the M&S disposal such as excess cash dividends, gain on disposal, withholding tax, etc. in 2021; onetime revenue contributions from services for BOT projects, including EPC services, that are provided by the Group's internal project management department, recognised under IFRIC 12 Service Concession Arrangements; and expenses incurred by the Company that are not related to the running of the GI Business, such as listing-related expenses and employee remuneration at the group level, etc.

5 GI operating cashflow refers to cashflow generated by operating activities of the GI Business.

GROUP FINANCIAL HIGHLIGHTS

Note: The 2021 and 2022 financial figures in the table above reflect the financial performance of the Group from continuing operations and excludes that of the M&S business following its disposal.

(1)After adoption of Amendments to SFRS(I) 1-16: Property, Plant and Equipment: Proceeds Before Intended Use that came into effect on 1 January 2022 and is retrospective for FY2021 financial results.

(2)FY2021 group PATMI excludes gain on disposal of RMB934.3 million and expenses incurred by the Company in connection with the M&S disposal, namely the excess cash dividend paid to Convertible Bond holders which is recognised as finance cost; project adviser fees; and withholding taxes.

(3)Underlying operating cash flow excludes annual CB interest. CB interest was RMB21.0 million in FY2021 and RMB11.3 million in FY2022.

2022 was the company's first full year of operation with GI business after the disposal of M&S in 2021. Group revenue in FY2022

was RMB3.45 billion, mainly due to ramp-up of GI business and contributions from services for BOT projects, including EPC

services, which are provided by the Group. PATMI without the financial effects of CBs in FY2022 was RMB136.5 million, which

reflects the operating results of the Group. Group underlying operating cash flow was RMB316.5 million in FY2022.

Note: The 2017-2020 financial figures in the charts above reflect the financial performance of the Group before the disposal of the M&S business. Group revenue was recognised under IFRIC 12 Service Concession Arrangements.

高端制造

高端制造 HSE & Quality

HSE & Quality